Td Ameritrade Tier 2 Requirements - You also acknowledge that if you trade on margin you are borrowing money from td ameritrade and that you understand the requirements and risks associated with margin as summarized in the margin account handbook and margin disclosure. Higher income, net worth, and investment experience seem to matter more than how much money is actually in the account.

Bitcoin Futures On Td Ameritrade - Edukasi News

However, professional accounts must pay $99 for streaming news, $30.50 for opra quotes, $23 for amex data, and $45 for nyse numbers.

/InteractiveBrokersvs.TDAmeritrade-5c61bc95c9e77c0001d321da.png)

Td ameritrade tier 2 requirements. Is compared to the underlying market at the option’s expiration. I've changed up my information and called the customer service but they said they have no control over the application review. New deductions from tier 1 and tier 2 capital y the most significant change is the treatment of allowance for credit losses.

Td ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. Only sep, roth, traditional, and rollover iras are eligible for futures trading. Options involve risks and are not suitable for all investors.

Did you ask td what their requirements are for tier 2 to see if you meet them? How much money do you need to trade td ameritrade? Higher delta means higher premium and thats awesome, but be prepared, the higher risk the higher chance of assignment.

Or have you updated your financials and network and perhaps provide back up if requested to gain approval? The requirements for futures are that you need to be approved for margin options trading (tier 2) and have advanced features enabled. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels.

Margin is not available in all account types. For example, assuming that you do not pay commissions, if you have $10,000 of settled cash in. Amtd) is the owner of td ameritrade inc.

Thinkorswim is owned by td ameritrade, td ameritrade is an american online broker based in omaha, nebraska. Tier 2 options approval td ameritrade. Td ameritrade holding corporation (nyse:

How to read level 2 on td ameritrade tos. Enable advanced features during the futures application process There is no limit to how many day trades you can make in a cash account as long as you are using settled funds.

Discussion in 'retail brokers' started by corello, jul 7, 2019. A minimum net liquidation value (nlv) of $25,000 to trade futures in an ira. Tier 1 capital is the primary funding source of the bank.

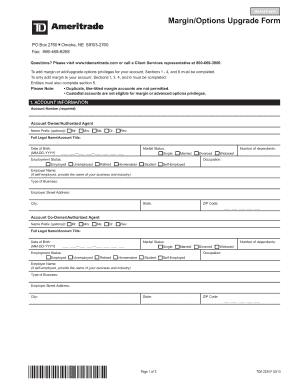

( nyse rule 431(g)(5)(b) and nasd rule 2520(g)(5)(b) state that eligible participants must be approved to engage in uncovered short option transactions pursuant to nyse rule 721 and nasd rule 2860. Approval usually takes two to three business days. Log in > client services > my profile > general > advanced features, click enable) an account minimum of $1,500 is required for margin accounts.

A 60 delta means there is a 60% chance you may have to pay out that insurance policy. I’m not too worried about. Y beginning in fiscal 2009, 50% of td’s investment in td ameritrade will be deducted from tier 1 capital, while the other 50% will remain as a tier 2 deduction.

The entire amount is currently deducted from tier 2 capital. Typically, an ―in‖ range binary pays off if the market ends up inside the range, while an ―out‖ range binary pays off if the market ends up outside the range. Tier 2 or 3 options.

Carefully review the margin handbook and margin disclosure document for more details. To apply for futures and trade them, you need the following: A higher delta means that the likelihood of the event occurring.

Advanced features enabled (to enable: Margin and options level 2 approval 2. How do i get approved for tier 2 options in my td ameritrade account?

Our requirements for pma approval are much higher than td and we require $175k to start and must maintain $150k portfolio margin for us requires level 6 options. I've tried twice to get approved and both times i've been denied. You understand and acknowledge that securities securing loans from td ameritrade may be lent to td ameritrade and lent by td ameritrade to others.

Margin trading privileges subject to td ameritrade review and approval. Td ameritrade requirements before you get started on your application, you will first need to make sure that you have the following settings or permissions on your account: If playback doesn't begin shortly, try.

Before trading, read the options disclosure document: Services offered include common and preferred stocks, futures, etfs, option trades, mutual funds, fixed income, margin lending, and cash management services. Margin and options level 2 approval.

The requirements for tier 2 and 3 are pretty vague and seem to be done on an arbitrary case by case basis. Notwithstanding the grantee eligibility criteria described above, td ameritrade reserves the right to Comment deleted by user · 5y.

Under elections & routing, look for futures, and click enable. Td ameritrade at a glanceaccount minimum$0account fees (annual, transfer, closing, inactivity)no annual or inactivity fee. Enable advanced features during the futures application process.

This is the classic risk/reward metric.

Td Ameritrade Review 2021 - Find All Features Pros And Cons

Best Options Trading Platforms In 2021 - Fee Comparison Included

Pin On Dribbble Ui

How To Trade Options Making Your First Options Trade - Ticker Tape

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2021

Td Ameritrade Forex Review 2021 - Forexbrokerscom

Pin On Bucks Business

Td Ameritrade Education Series Options - Youtube

How To Write A Covered Call On The Td Ameritrade Mobile App - Youtube

How To Invest In Futures Investing In Futures For Beginners 2021

Td Ameritrade Options Tiers - Fill Online Printable Fillable Blank Pdffiller

How To Sign Up For A Td Ameritrade Tier 2 Covered Cash Account - Youtube

Pin On Cool Iphone Game

Review Of Td Ameritrade You Think Its A Popular Brokerage Giant